Venture capitalists Franklin “Pitch” Johnson, William “Bill” Draper III, and C. Richard “Dick” Kramlich discuss the industry they helped to build.

On March 28, 2019, in an event jointly sponsored by the National Venture Capital Association (NVCA) and the Computer History Museum (CHM), venture capital trailblazers William Draper III, C. Richard Kramlich, and Franklin “Pitch” Johnson discussed the highlights and challenges of their long careers and legendary firms. Held in CHM’s brand new Learning Lab, the audience included venture capital colleagues from USVP and IVP to Lux Capital and B Capital. The panel was moderated by venture partner Christy Remey Chin of the Draper Richards Kaplan Foundation.

After the panelists nominated their favorite entrepreneur, which Bill Draper wryly compared to “picking one of your children,” the conversation explored the early roots of venture capital in Silicon Valley and how the industry has grown and changed.

Bill Draper, who cofounded Draper and Johnson Investment Company with Pitch Johnson in 1962, described how the two drove through the orchards of Santa Clara—before it was called Silicon Valley—on the hunt for tech companies to offer to invest in. Unlike today, when a well-respected venture capital firm may review hundreds or thousands of pitches a year, the early days were a time when no one really knew what venture capital was, including aspiring entrepreneurs.

Bill Draper recalls the early days of venture capital.

Dick Kramlich, who cofounded New Enterprise Associates (NEA) after a stint with legendary venture capital pioneer Arthur Rock, reflected on how and why he and his partners set up the bicoastal firm to last “one hundred years” and on its economic impact in job growth, which he believes is in the neighborhood of 300 million.

Dick Kramlich talks about cofounding NEA.

Dick explained how the industry has changed over time: from individuals and smaller partnerships to larger growth partnerships that then divided into smaller partnerships again with a few larger partnerships. He was adamant that since its founding in 1977 NEA has remained a “pure venture” firm rather than a private equity company. His definition of venture is “sponsoring new ideas with people who are in charge of their destiny in part and are willing to take all constructive advice.” Pitch Johnson also described the venture capitalist’s fundamental role in motivating and supporting entrepreneurs to build great companies.

Pitch Johnson outlines a VC’s fundamental role.

Moderator Christy Remy Chin also asked the panelists to share, from their experience, the most difficult obstacle facing new entrepreneurs. For Pitch, it’s running out of money when your projections and plans are too ambitious. For Bill, the key challenge is to find a managing team that meshes well together. Dick described in detail how perseverance is necessary to handle the fits and starts of developing a new product. The same might be said for developing a new industry, as these three pioneers have done.

The panel discussion was followed by a brief talk by the Exponential Center’s Distinguished Scholar, Sebastian Mallaby, a senior fellow at the Council on Foreign Relations and an award-winning author, who described how he hopes his latest book project on the history of venture capital will help explain the little-understood industry. NEA Cofounder and Chairman Emeritus of the Industry Advisory Board Charles Newhall III went even further in his closing remarks, claiming that the industry is not just little understood, but misunderstood. He made a passionate plea for venture capitalists to preserve and share their history to set the record straight for future generations.

In that spirit, the NVCA and CHM announced at the event that they have joined forces to preserve and make freely accessible the NVCA Oral History Collection, a rich online resource of interviews with industry leaders that is an important part of the Exponential Center’s ongoing venture capital initiative. The initiative aims to capture and share the stories of pioneering venture capitalists and their partnerships with disruptors and innovators that extend from idea to IPO and beyond. Through a variety of activities that capitalize on CHM’s core strengths, the center is exploring what the industry does, how it works, and what happens when venture capitalists and entrepreneurs join forces to create a company.

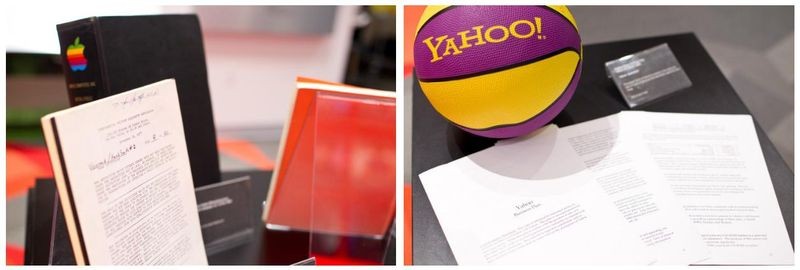

The pop-up exhibit showcased Apple’s 1977 Private Placement Memorandum submitted to Venrock from former Venrock partner Ray Rothrock, Apple IPO documents, a Yahoo branded volleyball, and Yahoo’s original business plan from 1995.

Moderator Christy Remy Chin, panelists William Draper III, Franklin “Pitch” Johnson, and C. Richard Kramlich and closing remarks speaker Charles Newhall III share their one word of advice to new entrepreneurs.

A pop-up exhibit showcased artifacts from the CHM collection that illustrate venture capital’s reach and impact with some of history’s most ground-breaking companies, including the original Digital Equipment Corporation business plan submitted to early venture organization American Research and Development in 1957, a 1982 Sun Microsystems operating plan submitted to West Coast Venture Capital, and a new board game for entrepreneurs created by Greycroft Partner Reid Hoffman.

The event also included a display of photographs of Silicon Valley venture capitalists with their “one word” of advice to aspiring entrepreneurs, including Greylock Partner Reid Hoffman; Ann Miura-Ko, cofounder of Floodgate; Alan Patricof of Greycroft; DFJ’s Heidi Roizen; Arthur Rock; and Hans Tung of GGV Capital.

Learn more about our One Word educational initiative.

“Trailblazers of Venture Capital,” March 28, 2018. Produced by the Exponential Center at CHM. Jointly sponsored by the National Venture Capital Association (NVCA) and CHM.

The Exponential Center at the Computer History Museum captures the legacy—and advances the future—of entrepreneurship and innovation in Silicon Valley and around the world. The center explores the people, companies, and communities that are transforming the human experience through technology innovation, economic value creation, and social impact. Our mission: to inform, influence, and inspire the next generation of innovators, entrepreneurs, and leaders changing the world. Learn more about our venture capital initiative.

The National Venture Capital Association (NVCA) empowers the next generation of American companies that will fuel the economy of tomorrow. As the voice of the US venture capital and startup community, NVCA advocates for public policy that supports the American entrepreneurial ecosystem. Serving the venture community as the preeminent trade association, NVCA arms the venture community for success, serving as the leading resource for venture capital data, practical education, peer-led initiatives, and networking.