If you were a senior executive in the Semiconductor Industry in the 1970s, 80s, and into the 1990s, you attended the annual Dataquest Industry Conference. Period. Everyone who was anyone was there. If you wanted to know how the industry was doing and how your company ranked within the industry, you looked to Dataquest. Everyone did. If your company was doing something interesting or important, you were invited to speak at one of their conferences. You didn’t turn them down. Dataquest conferences, newsletters, industry reports and market data were the most widely attended, most thoroughly read, and the most frequently quoted of all the industry data and opinion sources.

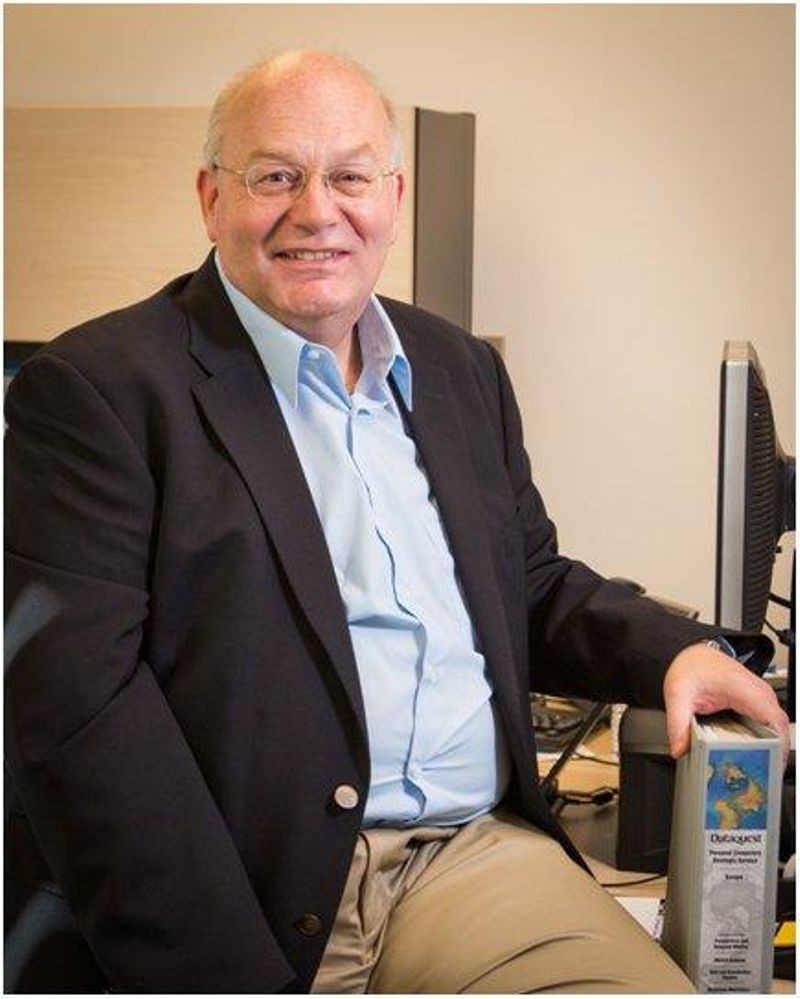

Jim Eastlake holds a 1995 Dataquest report. It’s the only hardcopy report we could find in Gartner’s San Jose office. Gartner has not delivered printed reports since the late 1990s.

And hundreds of those conference proceedings, industry newsletters, market share tracking information and a treasure trove of other critical data are now part of the Computer History Museum’s rapidly growing collection of artifacts, software, media, oral histories, and industry data. This Dataquest collection documents the explosion of Silicon Valley in the 1970s, the rapid in-roads made by the Japanese in the 1980s, and the rise of Taiwanese, Korean, and other Asian suppliers in the 1990s. Besides the US conferences, it also contains reports and conference proceedings from Europe, Japan, and Asia. The CAD-CAM-CAE reports include not only Electronic Design Automation, but reports on Mechanical CAD as well.

And how did this historical treasure come to be saved? It was really the foresight and determination of one individual, Jim Eastlake. Gartner purchased Dataquest in 1995. When it came time to consolidate offices and shrink the company’s footprint in 2005, volumes of hardcopy reports, some dating back 30 years, had to be disposed of. Jim, who has been involved with the Semiconductor Industry Service throughout his 25-year career with Gartner, knew it would be a tragedy to throw all that data overboard. He convinced Gartner management to spend $20,000 to scan any hardcopy reports they could collect, and preserve it for the future. Unfortunately, the material was not stored in neat order in a library. Jim had to go to each of his colleagues, primarily in San Jose, and request that they donate any historical information stored in their offices to this “scan it or lose it” crusade. As a result, hundreds of linear feet of reports have been reduced to a fraction of a “thumb drive” and are now in a place where they will be accessible to writers, historians, market researchers, and anyone else interested in the market and business history of the semiconductor industry.

One of those historians is David Brock, technology historian and co-author of ‘Makers of the Microchip.’ He notes that:

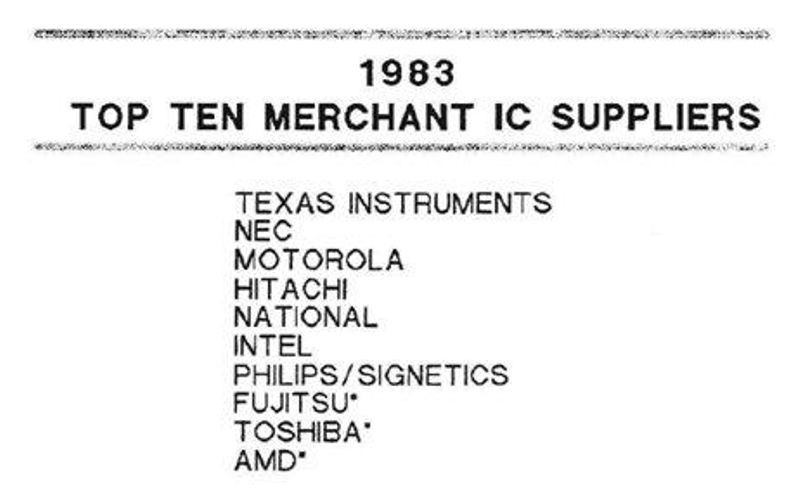

One of the most momentous shifts in the semiconductor industry was the rise of the Japanese vendors in the 1980s. Dataquest’s rankings capture this trend clearly:

NEC and Hitachi rise significantly and are joined by Fujitsu and Toshiba in the rankings. By 1988, the change was even more dramatic, 6 of the 10 largest vendors, including the 3 largest, were Japanese.

![]()

Note that Intel has not yet made it’s move, eventually rising to be the clear leader in semiconductors by the early 1990s, based on its dominance in the rapidly growing microprocessor space.

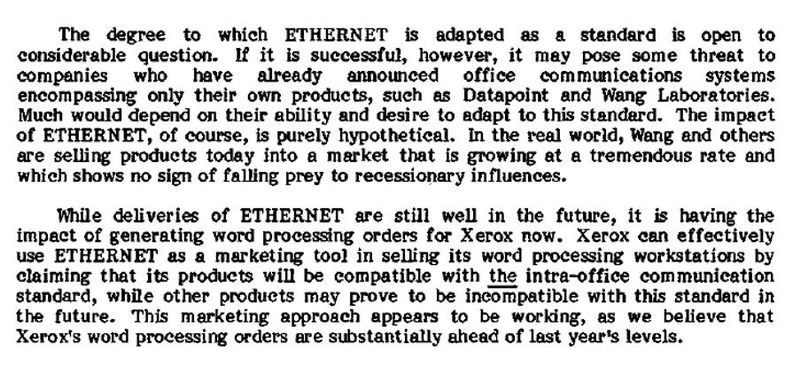

In preserving the past, we gain a better perspective on where we are and where we are going. These two paragraphs from a 1980 Dataquest Portfolio Letter, provide a useful reminder of how much has changed in the last 30 years….and the difficulty in accurately predicting the future in this rapidly changing world of semiconductors, software, and the internet:

Access the CHM Dataquest Collection here.