“Venture Capital in the Blood: Three Generations of Drapers in Silicon Valley,” April 19, 2017...

On April 19, 2017, three generations of the Draper family joined Marguerite Gong Hancock on the CHM Live stage at the Computer History Museum as part of a series of programs organized by the Exponential Center. Exponential focuses on capturing the legacy and advancing the future of innovation and entrepreneurship.

The Draper family, represented in this program by Bill Draper III, his son Tim Draper and granddaughter Jesse Draper, has played a defining role in Silicon Valley venture capital for four generations, spanning nearly 60 years. Guiding entrepreneurs from idea to exit, Drapers have served as investors, mentors, match-makers, and allies to founders of Hotmail, Skype, Baidu, Apollo Computer, Tesla, and more.

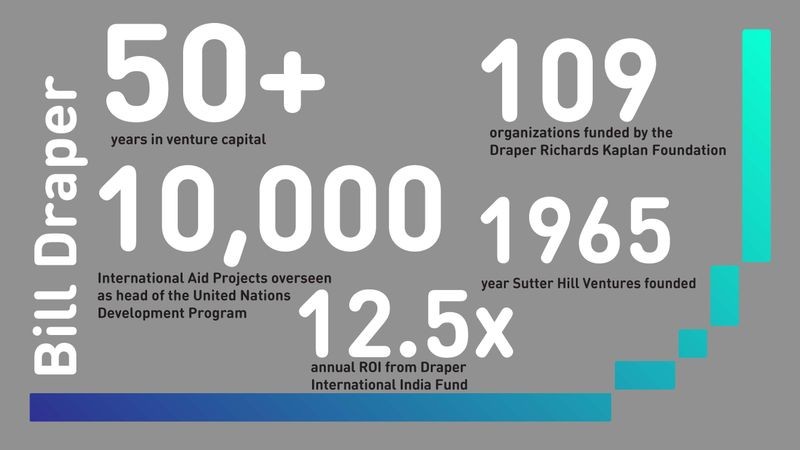

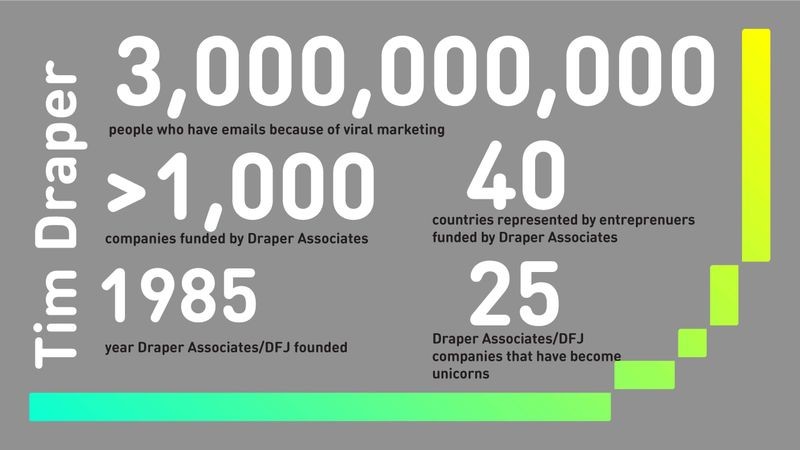

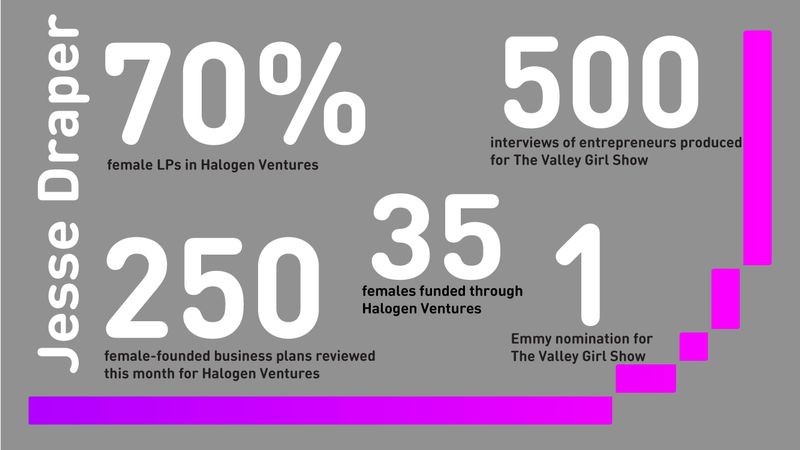

Some numbers about our panel:

The Draper family venture capital dynasty all started with General William Draper II, who at the end of World War II, oversaw the implementation of the Marshall Plan in Europe. Draper had been an investment banker in the Bay Area before the war, and on his return to the US, he joined with Rowan Gaither and Fred Anderson to form the first venture capital firm on the West Coast in 1958. Silicon Valley was a very different place at the time. As Bill Draper III noted, “Palo Alto was a little town . . . Mountain View and Sunnyvale . . . were mostly orchards . . . very informal.”

Bill Draper remembers the early days of venture capital in Silicon Valley...

The evening took on the tone of an informal gathering of the Draper family around the fireplace, rather than a scripted discussion of their wins and losses in the venture business. Bill Draper (whom the other two referred to as “Pops”) humbly remarked he had no idea what a wonderful story would unfold in the Bay Area and that he was lucky to have had “the right father.” Bill then turned to his son, Tim, with a big laugh and acknowledged that he may not have been so fortunate. Referring back to his father, Tim commented that a primary source of their family’s success was “dad’s optimism. That optimism has carried through the entire Valley.”

With such a positive and successful family legacy, you might think they had skipped the big disappointments. Tim commented that he didn’t feel too bad when a company they invested in didn’t quite make it: “At least we moved the ball forward.” It was those companies that they passed on but which went on to great success which were the most painful. Think Google (he already had invested in six search companies), or Apple (too high a valuation), or Facebook (outbid by another venture firm). But in the spirit of the evening, even these misses brought loud laughter from the stage and the audience.

Bill Draper on failure, lessons learned, and passing on Apple...

Tim Draper on failure, lessons learned, and passing on Google...

Bill Draper III had originally joined his dad’s firm, but soon struck out on his own to form his own venture firm, Draper & Johnson, with good friend Franklin “Pitch” Johnson in 1962. They remain good friends to this day, as captured in the photo below of the two together before the event. Bill later went on to form Sutter Hill ventures, a firm with an outstanding track record that survives to this day.

Bill Draper and Pitch Johnson

Tim originally envisioned himself as an entrepreneur, but quickly realized he had too many ideas about businesses to pursue and decided that the venture business was the ideal fit for him as well. He took over a Small Business Investment Company (SBIC) formed by his dad, and after a few years of declining value, he earned a place on SBIC’s “dirt list” for poor performance.

Tim Draper, from SBIC “dirt list” to “venture capitalist of the year” and building Draper Fisher Jurvetson...

Just in time, the IPO window opened, five of his companies went public, and he went from the “dirt” list to being SBIC’s “venture capitalist of the year.” A great testimony to the dynamics of the venture business! He subsequently was joined by others to form Draper, Fisher Jurvetson in 1985. Tim now invests out of his own fund, Draper Associates.

As with Tim, Jesse did not initially set out to be a venture investor. Instead she followed in her Aunt Polly’s footsteps and went into acting. After some success, but deciding acting was not the best use of her time, she founded The Valley Girl Show, one of the most popular YouTube shows, featuring business-oriented interviews with people like Elon Musk, Mark Cuban, Ted Turner, Sheryl Sandberg, and hundreds of others.

Jesse Draper on growing up with technology, forming The Valley Girl Show, and becoming an angel investor...

She has now expanded into early stage venture financing of startups with special focus on women entrepreneurs in consumer tech.

By the way, two of Tim’s other children were not featured on this program but are active in venture investing in Silicon Valley. Billy is on the investment team at Draper Associates. Adam is founder and managing director of Boost, which focuses on VR and blockchain.

Each of the Draper generations has clearly been able to capitalize on their predecessors learning and success, and at the same time carve out a path that leverages their own unique personalities and skills.

CHM Live’s “Venture Capital in the Blood: Three Generations of Drapers in Silicon Valley,” April 19, 2017. From left to right: Marguerite Gong Hancock, William H. Draper III, Tim Draper, and Jesse Draper.